I have been discussing the impact of demographics on the housing market for almost ten years (see here, here, and here).

My focus has primarily been on millennials, as I belong to this demographic.

After the Great Financial Crisis, many experts believed that millennials would never settle down, own a home, or buy a car. They were expected to live in big cities and avoid the typical suburban lifestyle.

However, I never found this line of thinking convincing.

I observed many of my peers moving to a big city after college and then purchasing a home in the suburbs once they got married or started a family. Millennials just delayed this transition longer than previous generations due to the GFC and the extended time spent in education.

Millennials, as well as Gen Z and Gen X, are on a similar path to homeownership as the baby boomers were at the same stage in life (source: Redfin):

This is a natural progression as individuals age.

While housing affordability may not be ideal at the moment, I anticipate that many young people will find solutions in the coming years. I would be surprised if the homeownership rates for millennials and Gen Z do not closely mirror those of previous generations. It’s a common pattern in our country.

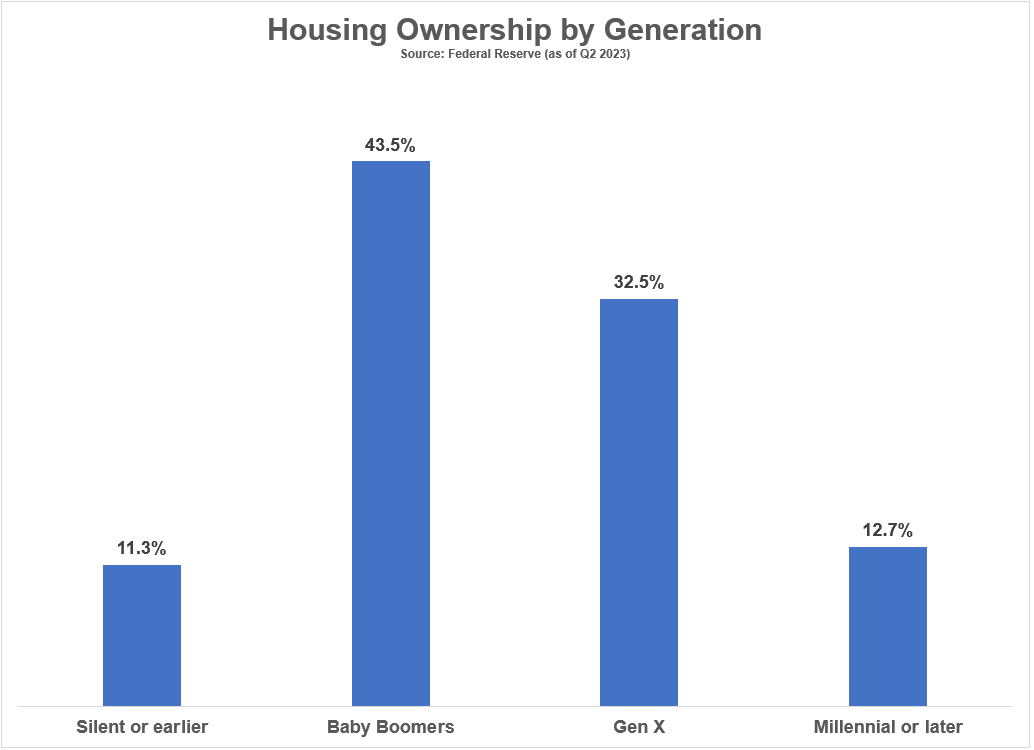

Turning the focus away from the younger generations for a moment, it’s important to note that the older generations currently control almost 90% of the housing stock in the country:

Yes, Gen X is now considered part of this older demographic. Interestingly, Gen X owns about one-third of the housing in the country, similar to where the baby boomers were in 1989.

What differentiates the current situation from past patterns is the unprecedented demographic of 70+ million baby boomers living longer lives, accumulating substantial wealth. The oldest baby boomers are approaching age 78, and the youngest near 60. With an average life expectancy of 88 for males and 90 for females, this generation is set to dominate the housing market for at least another 20 years, until Gen X takes over.

This demographic shift will bring fascinating changes to the housing market in the coming years.

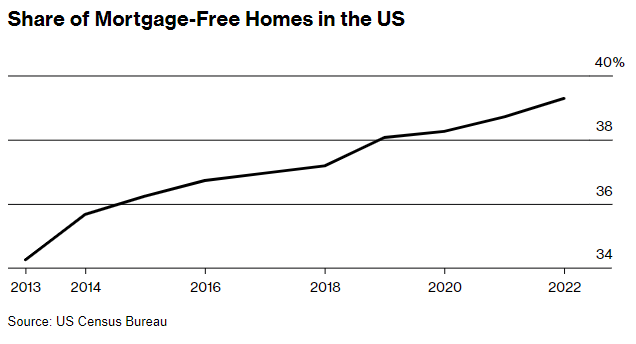

Take, for example, the growing number of mortgage-free, single-family homes and condos (source: Bloomberg):

Bloomberg’s analysis revealed that the number of mortgage-free homes increased by 7.9 million from 2012 to 2022, reaching 33.3 million according to Census Bureau data.

While there are challenges in the current housing market, older homeowners have distinct advantages, including owning homes outright, which provides them with financial flexibility and leverage for negotiation.

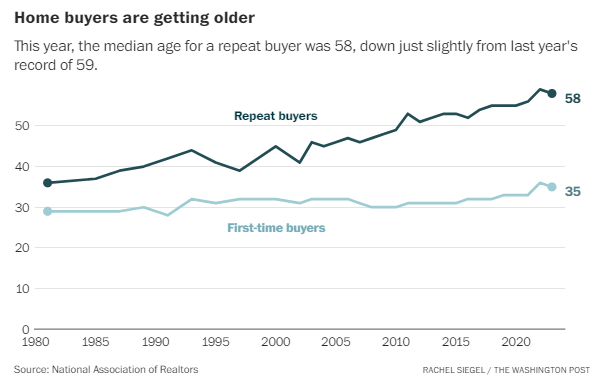

The trend is evident in the demographic shift of homebuyers, with the median age of repeat homebuyers approaching 60, up from 36 in 1981. Additionally, the average age of first-time homebuyers has increased from 29 in 1981 to 35, and the proportion of first-time buyers in the market has declined.

These shifts present challenges for first-time homebuyers, who are competing against older homeowners with built-in equity, higher incomes, and greater flexibility. The imbalance in the market has also resulted in reduced supply of homes for sale.

However, these dynamics will eventually change as life events lead to shifts in housing needs. With the passage of time, this trend is expected to reverse, although the timeline is uncertain.

The future of the housing market remains uncertain. While baby boomers are expected to dominate for at least another two decades, millennials will eventually become the driving force in the housing market.

For now, the older generations have the upper hand in the housing market.

For additional reading on this topic, you can explore “Did the Baby Boomers Ruin the Housing Market?”

1To estimate life expectancy, use the Social Security life expectancy calculator here.